Amazon's Retail Media Play: Party Over?

Amazon recently announced the launch of its Retail Ads Service, a new initiative aimed at extending its advertising capabilities to third-party retail websites.

Linkedin feeds are full of people that are both 'unsurprised' and highly opinionated on what it means from their vantage point. Those that appear to have the most to lose are Retail Media technology platforms.

Amazon Retail Ads Service is positioned as a solution to help retailers monetize their online properties, the service integrates Amazon's demand-side platform (DSP) with its ad-serving technology.

This move has sparked debates about its potential impact on the retail media landscape.

While the announcement has generated significant buzz, the offering itself appears to be limited in scope (three media types, legacy technology), primarily targeting smaller retailers who lack (or need) sophisticated advertising infrastructure. The value to Amazon is also dubious relative to Retail Media activity on their owned properties, so is it just investor relations corporate PR or is this the beginning of a larger opportunity for Amazon?

In this post, we provide an overview of previous initiatives by Amazon (and Google) to offer technology otherwise provided by dedicated technology vendors, we consider inherent conflicts, and analyze the gap between Amazon Retail Ads Service and the technology powering Amazon's own Ads business. This post presents a vision encompassing the dichotomy of consolidation and fragmentation. Ultimately we conclude that the whole market stands to benefit from Amazon as a Demand Side Platform (DSP), and that supply side considerations are more complex by an order of magnitude. The debate is a nuanced one, enjoy!

Past Proof Points: Precedent

Amazon, like Google, has long offered search and recommendation technology for retail websites as part of their respective cloud services. Note: Amazon's Retail Ad Service also requires retailers to use Amazon Web Services. However, the reality of domain specific implementations, the need for customization, complexity, support and ongoing optimization has prevented either company from taking significant market share from specialized search and recommendation vendors. Ironically, many of these vendors use Google Vertex and Amazon SageMaker as underlying technology within their SaaS products, highlighting the symbiotic rather than competitive nature of these offerings. SaaS vendors generally solve for specific users in ways that ancillary projects from tech giants do not.

Inertia and Switching Costs: Will Everyone Really Jump Ship to Amazon?

The assumption that retailers will switch en masse to Amazon’s Retail Ads Service overlooks the significant inertia and switching costs involved. Enterprise retailers have deeply embedded systems and workflows tailored to their unique needs. Migrating to an entirely new platform—especially one owned by a competitor—requires not only financial investment but also cultural and operational shifts that retailers are unlikely to undertake lightly.

Conflicts of Interest: Retailers & Amazon

- Reluctance to Enrich Amazon: Retailers of scale are typically uncomfortable lining Amazon’s pockets. As a competitor in the retail space, Amazon’s success often comes at their expense.

- Trust Issues: Retailers can’t trust Amazon to prioritize their interests over its own. If forced to allocate ad spend, why would Amazon direct dollars to third-party retailers instead of its own marketplace?

- Technology Disparity: Retailers worry that Amazon will always keep its proprietary tools a step ahead of what it offers others, maintaining a competitive edge.

Complexity in Enterprise Requirements: Mo' Money Mo' Problems

Enterprise retailers require bespoke solutions that Amazon’s current offerings cannot match:

- Customer Experience: Every retailer’s brand and customer journey differs significantly from Amazon’s. This uniqueness demands a high degree of customization.

- Varied Supplier Relationships: Supplier agreements and rebate workflows vary significantly not only across retailers, but within retailers where every supplier relationship is unique, necessitating tailored systems.

Hybrid Decisioning: Effective retail media requires seamless integration of trade, merchandising, own-brand promotion, site conversion optimization, and advertising—a level of nuance Amazon’s off-the-shelf solutions lack.

Legacy Tools & Limited Scope: A Golden Cage?

Kiri Masters’ exposé on Amazon’s Rufus AI patent highlights the limitations in Amazon’s Retail Ad Service technology as compared to the tech Amazon is benefitting from concurrently. The tools being offered are legacy systems, not the cutting-edge technology Amazon uses internally. This reinforces the challenges Amazon faces in making its latest innovations broadly accessible.

This blog post on Particular Audience’s website further explores these challenges, noting that Amazon’s own Rufus AI is tailored to its unique ecosystem. Adapting such technology to meet the diverse needs of each unique enterprise retailer is [currently] a monumental task, one that Amazon has yet to tackle effectively.

Consider the domain specific nature of training an AI search model as Particular Audience outlines in the 2023 Adaptive Transformer Search whitepaper available here.

Corporate PR: Spinning for Stock Price?

According to eMarketer "Amazon Ads is closing the gap with Google and Meta. The newest digital ad powerhouse is making the duopoly sweat, capturing 12.9% of the US digital ad market this year (behind Google’s 27.1% and Meta’s 19.5%)"

Public companies like Amazon have teams dedicated to spinning narratives that enhance their stock price. They've already expanded ads through owned ecosystems (Prime TV), and they need to keep the growth alive.

So let's unpack the opportunity Amazon Retail Ad Service has for Amazon...

Andreas Reiffen’s analysis on LinkedIn underscores the low revenue opportunity for Amazon’s Retail Ads Service, despite the media hype. As Andreas points out, the incremental revenue potential is limited (his back of the envelope calculation suggests Amazon might grow Retail Media Ad revenue by just 0.52%), which raises questions about the strategic focus of these initiatives.

At the time of writing, The Trade Desk's market capitalisation stands at US$ 58.8 billion, demonstrating the massive size a dedicated Demand Side Platform (DSP) can achieve.

Brand Advertisers are screaming out for consolidated entry points in an increasingly fragmented market. Lauren Livak of The Digital Shelf Institute recently shared at NRF in New York that brands, on average, will engage with up to seven retail media networks They simply cannot manage campaigns across more. Retail Media teams and budgets are not scaling linearly with the growth of Retail Media networks, Amazon's DSP could offer tremendous scale for an Advertiser, akin to Skai, PacVue and Criteo; it is unlikely that Amazon will restrict demand flows only to its limited onsite technology, when it can take a slice of the Open Web too.

The likely case is that Advertisers are Amazon's main target, not Retailers.

On the contrary, Amazon understands the tremendous complexity in configuring product search and discovery across unique websites with unique product catalogs, and unique personalisation and merchandising requirements. It is likely that Amazon, instead, considers their Retail Ads Service onsite offering as a blueprint for interoperability in a market that has yet to establish Real-Time Bidding (RTB) Principles.

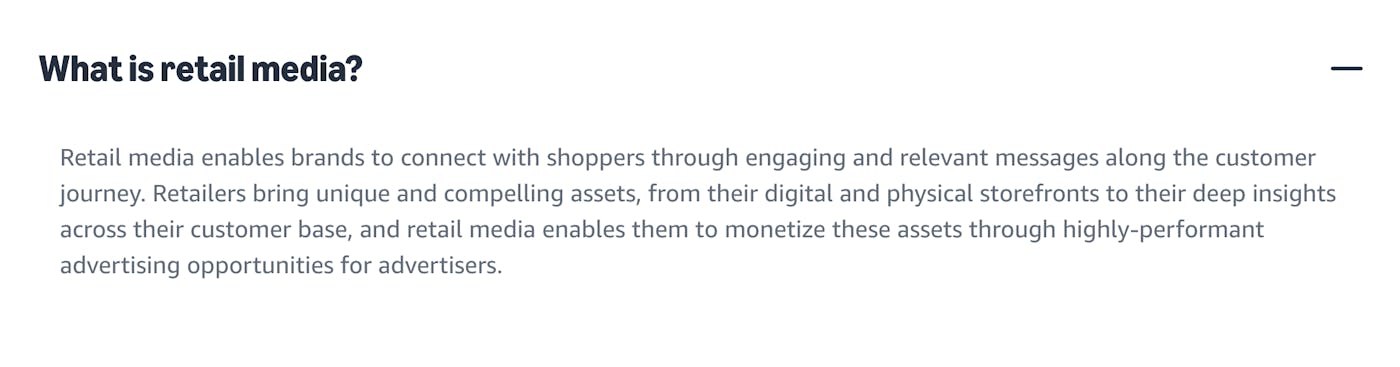

No other media channel can match the conversion power of retail media for brands, and align objectives between retailer, supplier and customer. Retail Media integrates deeply with the customer journey, offering unparalleled opportunities for search intent capture, personalization and conversion. Fortunately we have a powerful precedent to refer to as outlined above.

Market Implications

The limited market share Amazon and Google have gained in retail search and recommendation systems reflects the complexity of implementing these technologies. Advanced search and recommendation technology is the foundation of successful Retail Media. This precedent suggests that Amazon’s Retail Ads Service is unlikely to disrupt established vendors.

Instead, we believe it will unlock opportunities for smaller retailers who lack the resources to attract advertiser attention independently, and are too small to afford specialized technology.

Retail Media Is Just Getting Started: Why There’s More Than Enough Lunch for Everyone

There’s a subset of voices in the industry who argue that retail media is too fragmented, that there are too many tech vendors, and that consolidation is inevitable because "there isn’t enough lunch for everyone." This perspective fundamentally misreads both the trajectory of digital advertising and the scale of the opportunity in retail media.

The same skepticism existed in the early days of programmatic advertising. Many believed that a handful of dominant players would control the ecosystem. Instead, we saw the rise of a thriving ad tech landscape, where innovation flourished, and a multitude of specialized players emerged to meet the complex needs of advertisers and publishers. The open web didn’t consolidate into a single platform; it diversified, creating a vast industry supporting everything from DSPs to measurement providers and AI-driven optimization tools.

Retail media is on a similar trajectory. The shift from generic, manual ad placements to AI-driven, intent-based decisioning is still in its infancy. Retailers are increasingly recognizing that their first-party data is an immensely valuable asset, and brands are eager to tap into it in ways that go beyond simple keyword targeting. This isn’t a market with room for only a couple of players—it’s an evolving ecosystem where differentiation, automation, and intelligent decisioning will define the winners.

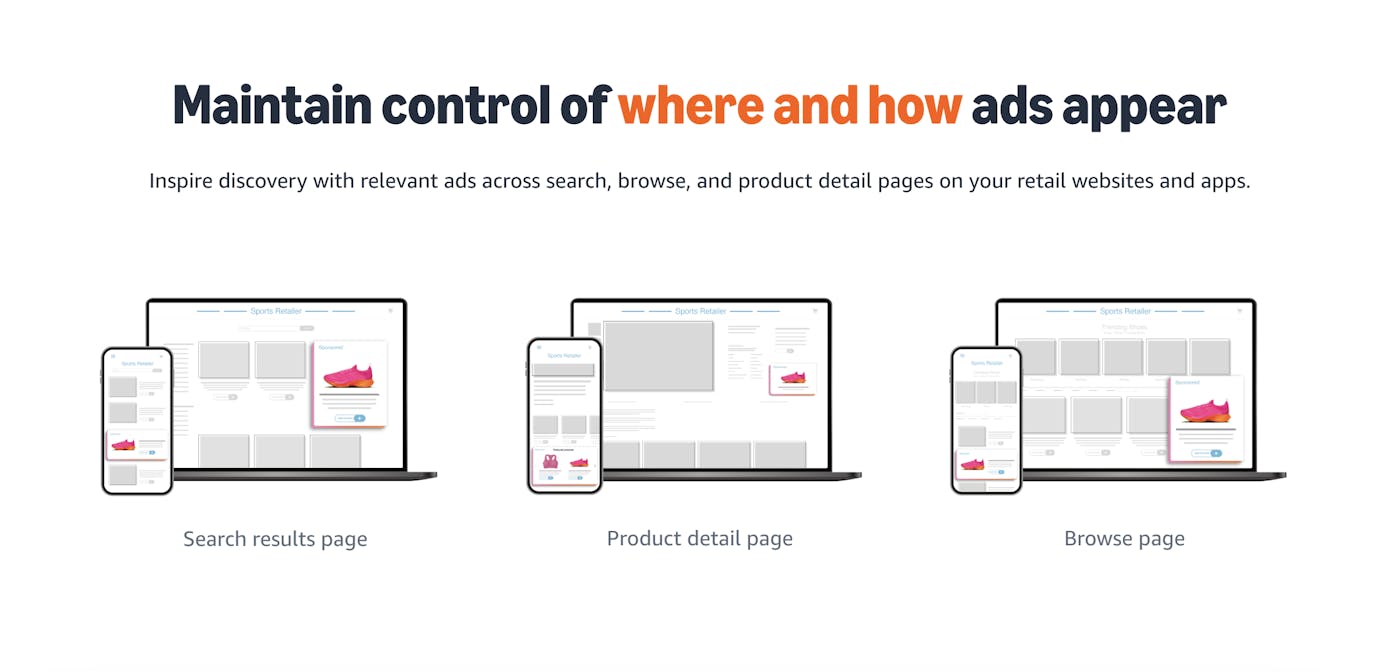

The reality is that the retail media opportunity is still expanding. Retailers across every vertical—from grocery to fashion to electronics—are building their own media networks. New formats are emerging across on-site, off-site, in-store, and connected TV. Every retailer has a unique audience, unique data, and unique ad inventory, which means there is no one-size-fits-all solution.

Rather than a race toward consolidation, we’re seeing a market evolving toward interoperability, where multiple vendors and solutions can coexist, integrate, and optimize outcomes. The best technology won’t be the one that forces consolidation—it will be the one that enables retailers to maximize their media potential without sacrificing control.

The future of retail media isn’t about who gets the biggest slice of a fixed pie. It’s about expanding the pie itself.

The marketshare consolidation point of view assumes the technology is a solved problem. It isn't. We may see consolidated demand side interfaces rise as one-stop-shops for advertisers. We will see a modular, specialist, integrated ecosystem continue to develop.

A Vision for the Retail Media Ecosystem

The retail media space has vast potential for growth. Comparing it to the broader ad tech ecosystem—with its exchanges, mediation platforms, DSPs, and SSPs—illustrates how much remains to be built. Amazon’s DSP may grow to rival giants like The Trade Desk, but the supply side of retail media will remain distinct per retailer. The search and personalization SaaS market has not consolidated, and we don't expect onsite retail media vendors to either -- the technology and managed service requirement is too high touch, to maximise unique conversion capabilities that only this channel can provide. That said, consolidation is required on the demand side, to give brands a manageable interface to this channel. The DSPs that position themselves to capture this trend will not only dominate in marketshare, but also define the standards that bring RTB principles and other mature ad tech ecosystem components to Retail Media. To quote Jeff himself, "it is always Day 1", especially for Retail Media.

Conclusion

Amazon’s foray into retail media is a net-positive for the industry, unlocking opportunities for smaller players with plug and play technology that immediately has access to demand, while leaving room for specialized vendors to thrive. Despite its scale, data, and technology, Amazon faces significant challenges in addressing trust, customization, and enterprise complexity. The future of retail media belongs to those who can navigate these nuances, delivering tailored solutions that align with the unique needs of retailers and advertisers alike.

In a word, "bullish".