Emma Dean, COO of SMG - the World's leading Retail Media agency and Jessie Bove Dowd, Editorial Director of P2PI, the World's leading CPG insights, research and retail media institute co-hosted The Great Retail Media Debate on whether Retail Media is the latest marketing bubble about to burst.

Retail media is predicted to be the fastest-growing media channel in 2024, overtaking total TV advertising spend by 2028 with no signs of slowing down. But it begs the question: how much longer can this hype and growth possibly continue for? Are we reaching a ceiling? Has retail media reached its zenith, or is the best yet to come?

Panelists Babs Kehinde, Senior Director of Commerce Media at PubMatic; Taylor West, Head of Sales at Clinch; and Nick Larkins, Co-Founder at QSIC; joined Particular Audience CEO & Founder James Taylor on stage at Europe's largest Retail Media event in a heated debate.

The Retail Media Bubble

Keyword targeting is past its peak

"Keyword targeting is past its peak", PMAX, Meta, and every major internet advertising ecosystem has moved beyond manual targeting. Advertisers expect a ~let AI do it~ option.

Algorithms influence who we talk to, what we buy, where we go, and who we marry. Unshackling Retail Media from manual settings and human approvals is what is unlocking the next phase of growth. Particular Audience is here for it.

Outside of Amazon and Walmart, on-site search in other Retail Media Networks is currently dominated by rules based keyword targeting solutions. These legacy platforms do not scale well:

- advertisers lack time and resource to build ad campaigns

- custom experience is put at risk

- manual approval processes constrains growth with human bottlenecks

Offsite is hard to drive profit, is it sustainable?

Offsite, in-store and CTV are dwarfed by and will continue to be dwarfed by on-site mediums. Is the juice worth the squeeze?

A bubble, by definition is where hype exceeds reality. Proponents of offsite and in-store argue larger potential audiences, but the Capex and margin considerations introduce a heavy dose of reality to RMNs expecting to turn on the money taps.

True omni-channel measurement and attribution is an unsolved problem for 1-to-many ad formats. Compare this with closed-loop onsite ads with direct 1:1 targeting, measurement and SKU level attribution.

All marketing plays its own role in a complex and evolving funnel from awareness through to conversion, from consideration to loyalty, advocacy and delight. We know billboards work, so layering retail specific signals into digital out of home does drive tremendous value as part of a broad media mix.

Offsite advertising in retail media should be treated with caution. Firstly we ought not to line the pockets of the very ad networks Retail Media Networks are competing with in the first place -- Amazon and Walmart benefit from owned media, for other Retailers to pay to play on Google and Meta Platforms is a different kettle of fish when it comes to profit margin.

Onsite revenue has 14:1 growth headroom, according to one Particular Audience case study of cross-funnel machine learning driven sponsored products as compared with a keyword only approach (in the electronics vertical).

Retail Media already makes up more than 25% of digital advertising investment today, and by 2028 the panel voted it will be bigger than TV advertising spend by 2028. However, just because a brand spends on Out of Home advertising and TV advertising, does not mean they will transfer this spend to category specialist retailers or even multi-category giants. The rising tide lifts all ships, and the quality and merits of retail media will sure enough continue to allocate it more of the pie.

In the future Retail Media will be, 'Media'. The data structures around retail are a material improvement on the media of yesteryear:

- Context, Action & Targeting: Customers search, browse, compare and buy products

- Consistency, Organisation & Data: Products have images, descriptions, tags and attributes

- Machine Learning: Turning all of these data points and inter-relationships into contextually relevant and accurate predictions -- trumping other ad formats, and driving measurable outcomes.

The future is bright for Retail Media. Especially Onsite.

In addition to the debate, some world class guests tabled some world class points - more below.

Demographic Targeting is Dead

Demographic data is completely outdated, you are what you buy.

Jenny Holleran of 84.51˚ Kroger Precision Marketing shared fundamental truths in retail media effectiveness and efficiency for brands trying to grow consumers.

In fact, Jenny was able to highlight the efficiency of a honed and toned Retail Media Network like Kroger's driving the same sales with 51% fewer impressions. The value of relevance is critical to maximising engagement and conversion.

To achieve this, Jenny said it clearly, “demographic data is completely outdated, you are what you buy”. Behavioural and contextual targeting outperforms segmentation every time, and yet the entire Retail Media industry still seems obsessed with targeting customer segments and keywords. Spotify and Netflix share something in common which the world of Retail Media outside of Amazon and Walmart is just waking up to: patterns exist between what we listen to, what we watch and (you guessed it) what we buy. If you can understand customer context, you can predict what else they are likely to be most interested in, ergo ~the right product, in front of the right customer at the right time.

Understanding the logic behind this level of personalization can be a real head scratcher as it is more about the relationships between items than about tenuous customer specific data points that have assisted with legacy approaches to segmentation. Particular Audience is the only Retail Media platform built with machine learning powered product recommendation engines.

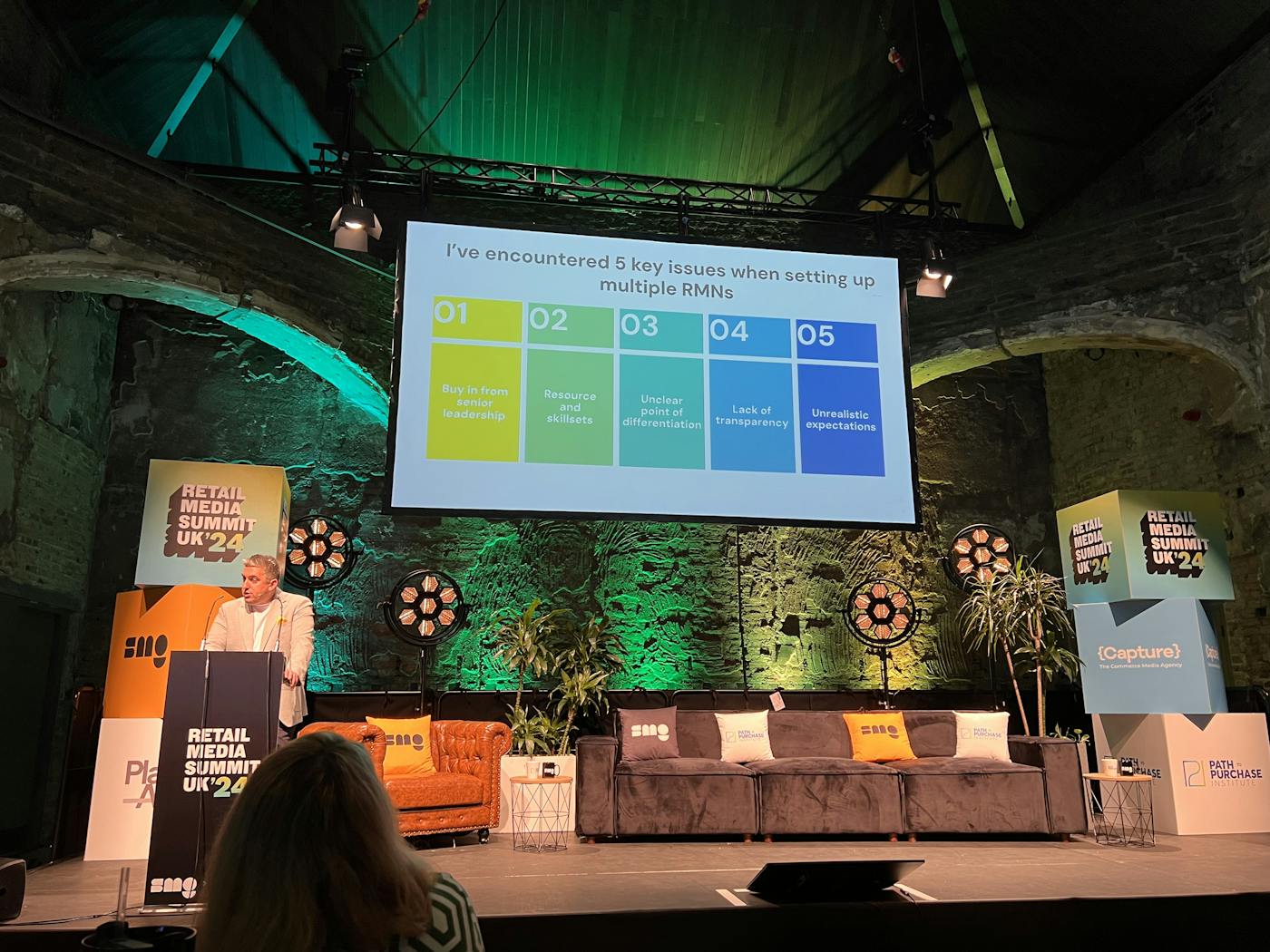

5 Key Issues for Retail Media Networks

I've encountered 5 key issues when setting up multiple RMNs

Operational and organisational change seem to populate the leaderboard for reasons that Retail Media Networks do NOT get off the ground, or struggle with head winds.

- Buy in from senior leadership

- Resource and skillsets

- Unclear point of differentiation

- Lack of transparency

- Unrealistic expectations

Incremental Value in Retail Media

We can track purchases at an audience level, to understand whether the campaign had a lasting impact

Bianca shared impressive data from Boots Media Group outlining 'before and after' Retail Media Campaign impact for Test and Control group audiences, demonstrating a sustained uplift in sales for audiences impacted by a Retail Media campaign.

Bianca went on to show how tracking New To Brand vs Lapsed and Current customers, achieves a 10.2% repurchase rate for New to Brand (NTB) shoppers.

In her insights, she concluded how she is calculating the long term value of these new to brand customers.

Brand Average Transaction Value x Brand Purchase Frequency = Average Annual Customer Value

All in all, a brilliant event packed full of critical insights and a room full of the industry's leading people. We will be back next year, for the UK's leading Retail Media event.