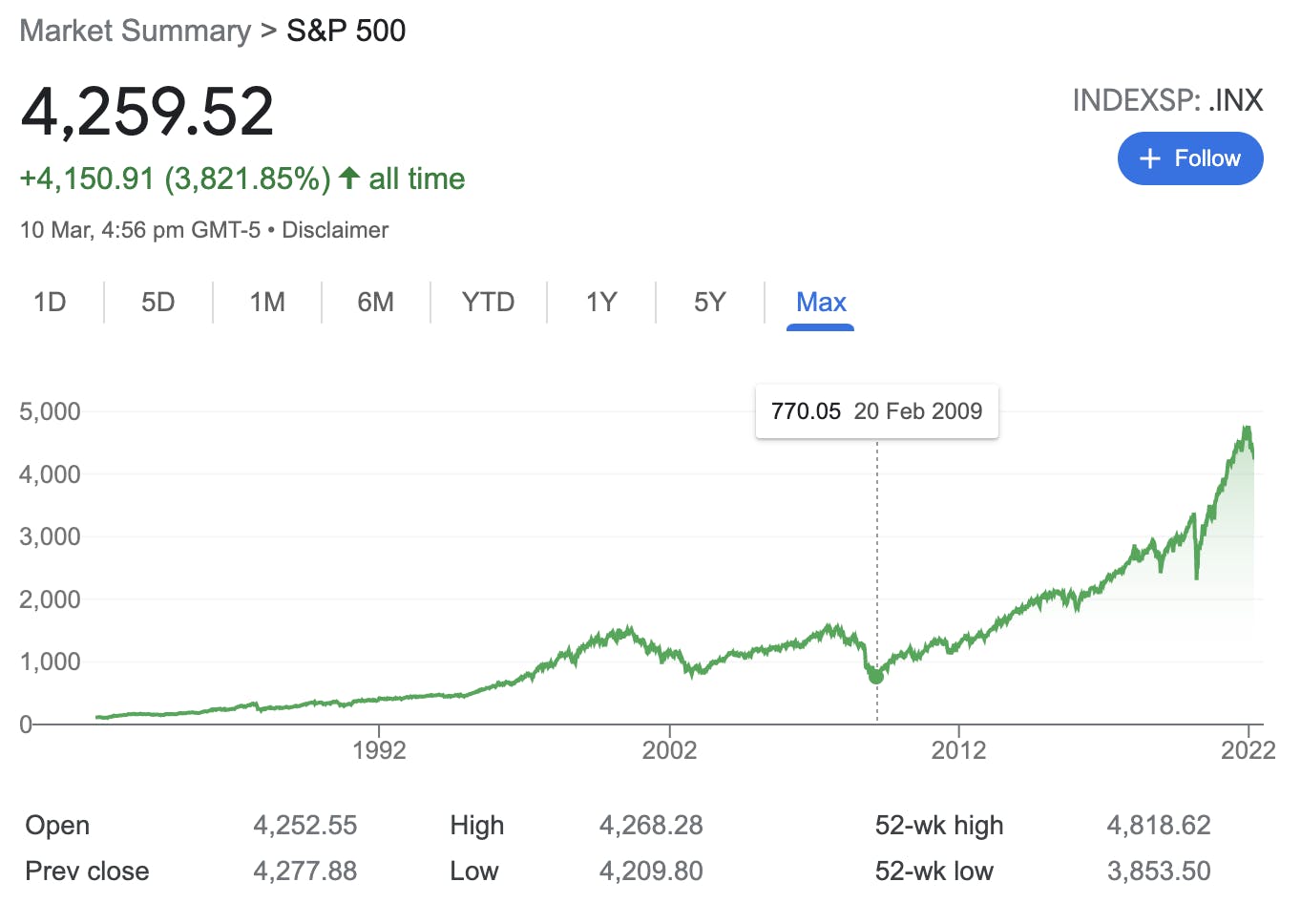

More than a decade of printing money and extremely low interest rates followed by helicopter stimulus born out of a pandemic response have exacerbated the longest bull run in history.

In that bull run we witnessed asset price inflation at the end of 2021 to a measure of (cyclically adjusted) 40x earnings in equity markets, more than double the long standing average.

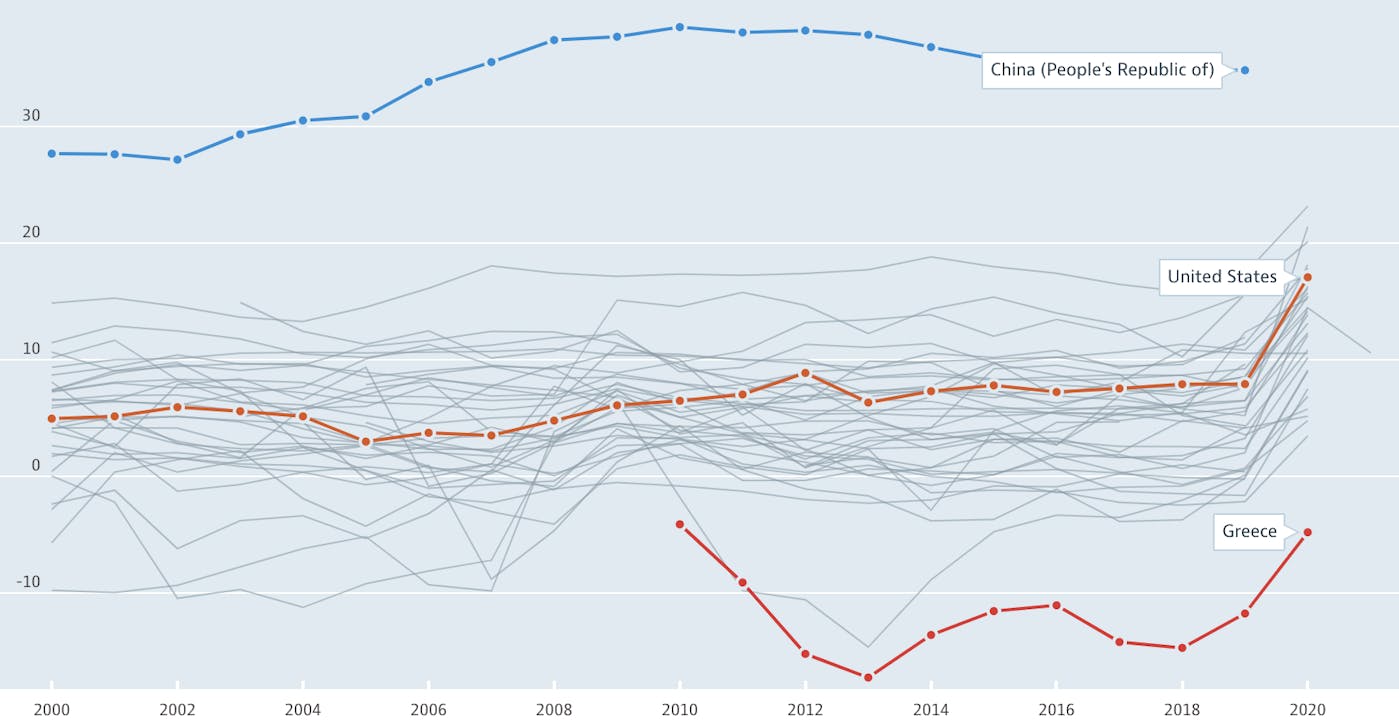

While the owners of assets have gotten richer, non-asset owners have become relatively poorer, reflecting a growing wealth gap.

Overall the economy is healthy, unemployment is at historic lows and household savings are strong.

Retail is alive and well, with eCommerce absorbing the $ from bricks and mortar lockdowns of the last 2 years.

The global economy is so healthy that, in fact, a perpetual growth environment has inevitably run into capacity constraints.

In 2021 inflation was first felt by corporations, quickly passed onto the consumer and while initially touted as ‘transitory’, inflation has persisted and increased. Inflation is not only a long overdue trickle down effect from capital markets (pricing out many from property ownership for example) but has been shocked and stress tested by supply chain bottlenecks as well as other capacity shortfalls including labor and the resulting wage growth.

Energy costs have risen too. Energy prices are now skyrocketing with the Oil & Gas scarcity enforced by the isolation of Russia following their invasion of Ukraine.

War can drive inflation or stagflation, but where energy prices, commodities and utilities are concerned it is more likely to be the former.

Consumers rarely notice inflation

In this article we evaluate what inflation, and not just the consumer price index inflation we have read about in headlines lately, but how broader market inflation has created a higher real rate of inflation (i.e. it is disproportionately more expensive for you to buy a house now vs 10 years ago). Critically, what that means for the economy where we are specifically concerned with what inflation means for consumer confidence and for margins in retail and eCommerce businesses, as well as the operators and the investors that fund them.

We are specifically concerned with what inflation means for consumer confidence and for margins in retail and eCommerce businesses, as well as the operators and investors that fund them.

We also consider whether markets are *actually* overvalued or whether they are simply baking in the inevitable rise in future cash flows, not because business is set to do well but because currency is worth less (because governments printed more currency - more on this shortly).

Earnings multiples (high valuations relative to income) could in fact be pre-emptive to the fact that future cash flows really will be higher in absolute dollar terms, due to inflation depreciating currency rather than real growth.

What if currency is worth less in the future?

Warren Buffet famously wrote in 2012 that

"...the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than US$7 today to buy what US$1 did at that time. Consequently, a tax free institution [since tax further erodes real returns] would have needed 4.3% interest [return] annually … to maintain its purchasing power."

This is a natural way to think about inflation, not that things get more expensive, but that the value of the currency has dropped. We believe currency has more or less halved in value since 2009.

Equity valuations (or ‘earnings multiples’) are how you measure the value of your business and are simply a net present value (what money received in the future is worth today) of future cash flows applying a discount rate that is typically assumed as a product of inflation expectations and by relation, expected long term interest rates. Beyond that fundamental measure, you also have market sentiment, that is the ‘opinion’ or ‘emotion’ of players in the market - that is why stocks tend to swing lower than trendlines during pessimism/panic and higher than trendlines during optimism/elation.

As a retailer, your enterprise value is the money you expect to earn in the future adjusted for that money being worth less than it would be if it were earned today.

Current multiples (the premium investors are happy to pay on current cashflows) suggest the market is assuming earnings will continue to grow forever without hindrance. Hindrances that may include collapsing consumer confidence, higher interest rates, and cost inflation that eats away at margins.

Though this can also be exacerbated by the fact that no one wants to be sitting on cash while capital markets fly.

We are in uncharted economic waters and rocky hindrances are in sight

A retailer is in the business of ‘investing’ cash into inventory which they hope to then sell at full margin and as quickly as possible. A retailer is in the business of making profit from the margin in between sale price and cost price.

An optimal retail business

- Reduces the landed (delivered) cost of an item.

- Minimizes markdowns (discounts, triggered by an inability to sell enough quickly).

- Constantly improves cash-on-hand to inventory ratios (giving them flexibility to re-invest in the highest performing stock and/or marketing channels, deliver loss leaders etc.)

- Controls operating leverage, which means reducing variable price (costs that scale with output, e.g. sales commissions, shipping/delivery) to fixed price (costs that stay the same, e.g. rent, equipment) ratios so that an increase in sales can drive a higher profit more reliably.

Further to operating optimally, retailers (like any corporate) can increase earnings by… to quote Warren Buffet once more:

“Corporations would need at least one of the following: (1) an increase in turnover, i.e. in the ratio between sales and total assets employed in the business; (2) cheaper leverage; (3) more leverage; (4) lower income taxes; (5) wider operating margins on sales.”

The good news is leverage is extremely cheap right now, and any fixed rate loan is a good deal. The bad news is, rates must rise to stem inflation, and although war time economic catastrophes may put increased pressure on governments to keep rates low, banks will likely increase their own risk margins on lending if war and economic risk grows.

Inflation of course negatively impacts point 5, a desired wider operating margins on sales. Fortunately for retailers there are ways to optimize operations to increase earnings. These methods typically require advanced machine learning platforms to help manage customer experience and demand and inventory allocation, like products we offer at Particular Audience.

Money printing and why it leads to inflation

Following the credit crunch and economic collapse during the GFC (Global Financial Crisis 2007-09), government debt in the west reached all time highs, requiring further stimulus in domestic economies. Quantitative easing, or ‘money printing’, solved both problems by shoring up banks, appeasing lenders, and increasing liquidity. All at the risk of devaluing currency in the hope that economic growth would counteract it. What a decade it has been!

Quantitative easing is the process where governments buy back debt from financial institutions and other investors who previously lent them money through investing in their government bonds in the first place.

The reason this has led to asset price inflation (as opposed to consumer price inflation, i.e. your weekly grocery shop) specifically, is because money (which didn’t exist previously) was ‘printed’ to buy back these bonds, and therefore ended up in the pockets of financial institutions who could then lend and invest this excess money elsewhere,thus increasing the money supply and driving up asset prices in capital markets.

One benefit is the increased liquidity of banks, allowing them to lend more and stimulate the economy. However, with interest rates low, the returns available in lending were not as attractive as buying equity which stood to make higher potential returns in a low cost debt environment (this is called leverage). Whether companies themselves were leveraging up or investors were leveraging to buy equity, it didn’t matter. In this instance we saw both happening simultaneously, overall leverage (i.e. borrowing to increase return on equity) increased as did downside risk.

Money supply, debt and equity in capital markets has ballooned.

To put this simply, money supply refers to the total value of all money available for spending in an economy. The money supply can be manipulated by governments and central banks to adjust overall price levels, with a higher or lower money supply having a direct effect on inflation.

In plain english, the most common ways of measuring money supply are:

M1 (narrow measure): M1 represents the most "liquid" form of money in circulation. In other words, it is cash and cash equivalents that can be accessed right away. M1 includes currency, checking account deposits and travelers' checks.

M2 (broad measure): M2 includes everything in M1 in addition to savings deposits and time deposits under US$100,000. Time deposits over US$100,000 are classified as large time deposits (LTDS).

There are also M3+ tiers but we won’t go into that detail for this article.

To explain the essence of money supply and inflation, let's run a goldfish pond elementary school example (ergo oversimplification) of our economy. Imagine an isolated but active market of 10 dollars and 10 apples, with each apple being worth $1 ~ what might happen if you print and distribute an extra 10 dollars to bring the money supply to $20, while keeping asset supply at the original 10 apples? In our fish pond based economic vacuum the apples become worth $2 each. Here’s the important bit to understand: the apples have not doubled in value, but the value of the dollar has halved.

Investors have influenced markets given even a sniff of monetary or fiscal tightening, punishing the politicians with corrections, and swiftly recovering when policy makers back off.

Policy makers have been malleable because inflation was either non-existent or ‘transitory’.

Loose monetary policy created inflation that made asset owners very wealthy, it devalued the currencies it was printed in, and it made non-asset owners relatively poorer - widening the wealth gap.

Further loose monetary policy occurred throughout COVID-19 in the form of handouts and grants (helicopter money supply), keeping unemployment at bay through a pandemic.

All this kept economic productivity high, money cheap and capital markets roaring.

However, growth cannot exceed capacity and capacity had been well and truly tested. A supply chain shock led to initial spikes in inflation first felt by brands, retailers and then consumers. IKEA were early in raising prices by 9% to compensate, with many others following suit.

Consumer inflation that you and I experience directly, and as measured by CPI (the consumer price index) has subsequently risen, and risen, and continues to rise.

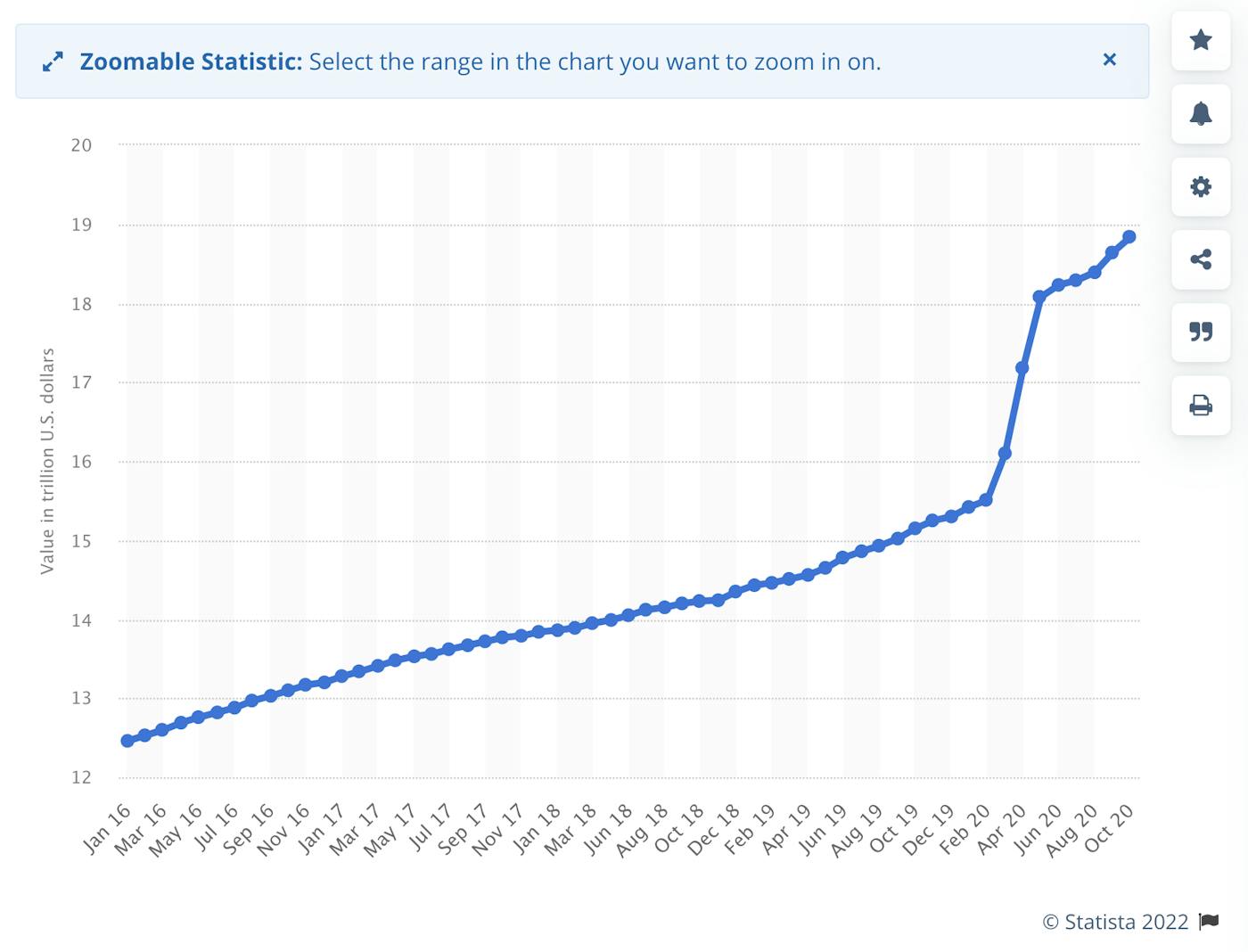

Scale of QE

By January 2022, 8.87 trillion dollars of US$ has been printed through QE in the USA alone, much of it absorbed by asset prices (our apples).

To consider that scale, there is just US$1.5 trillion dollars (M0) of physical cash in circulation in the USA.

There is approximately US$ 40 trillion in circulation including all the physical money and the money deposited in savings and checking accounts (M1).

M2 was greater than US$ 20 trillion in mid-2021. Up from US$ 11.8 trillion in 2015.

Taking the USA and its US$ as our goldfish pond, money printing in real life is not too dissimilar to our elementary school example and our US$2 apples.

In the whole world, according to McKinsey, global assets grew from US$ 440 trillion (approximately 13 times GDP) in 2000 to US$ 1,540 trillion in 2020. This figure includes real estate prices, equity market prices, exchange rates, natural resources, human resources, as well as capital and technological advancements that may create new assets or render others worthless in the coming years.

Money supply growth picked up big time.

Other things that cause inflation too

Inflation is also caused and contributed to by things outside of the money supply - most prominently government fiscal policy (taxes, public sector spending). In our instance, other key factors include:

- Supply chain shocks from aforementioned capacity constraints

- Energy and commodity prices

- War

In a perfect storm, all of these issues have now reared their heads and continue to put upward pressure on the cost of goods.

Energy prices are up, and have subsequently skyrocketed following Russia’s invasion of Ukraine. The economic sanctions imposed against Russia that block oil and gas sales (which much of the world depend upon) have forced rapid discovery on alternative energy sources and oil is approaching all time highs.

Well guess what, everything (production, transport, keeping the lights on) requires energy and energy is a massive inflationary cost driver.

Rising energy costs paired with excessive money supply, government spending and low tax environments create a recipe for extreme inflation triggers. We can expect that interest rates will spike to contain these mechanisms, having an adverse impact on consumer confidence, purchasing power of money and business profitability.

I’m a retailer, what does this all mean for me?

Retailers purchase goods and (ideally) sell them for a profit. They need low prices and hungry customers.

Consumers need some money to spend on goods, and in many retail categories they need enough surplus cash (and confidence) to afford discretionary spending.

Costs are going up, and consumer appetites are uncertain. Some retail categories such as staple FMCG products have tremendous pricing power and the ability to raise prices without impacting demand, others are less fortunate.

Inflation is dissolving the value of people’s savings, but does that mean they are likely to spend more? People with mortgages will need to service debt at a higher cost so they’re likely to be worse off financially, but the young assetless class may elect to invest their cash in experiences. It’s all a little unclear - travel is a great experience but the cost of flying is rising with oil prices.

In the remainder of this article we evaluate both various consumer categories and then various retail, specifically eCommerce, categories to predict the impact we expect inflation to have on them.

Consumer analysis

Let’s first look at consumers. They are, after all, what makes retailing possible so it’s important to consider how different market segments are going to be impacted.

Who does well with inflation?

Generally we don’t notice inflation when it is kept in check. New technology costs more than older technology did, wages increase and investments do well. We seldom notice when a chocolate bar costs $1.30 vs $1.

Extreme inflation has a noticeable effect.

Workers taking home paychecks may find themselves with more disposable income in a high-inflation scenario if their wages grow faster than the price increases brought about by inflation. Wage inflation is already underway in the Anglo-West with immigration down and the great resignation up, but this is an inflation driver in and of itself.

Notably, those whose wages have increased and who owed money at fixed rates before the inflation occurred find themselves with more money from their paycheck to pay off debt, meaning they pay less interest in an inflationary environment.

Inflation can be good for borrowers who owe money at fixed interest rates, debt becomes easier to pay back.

Asset owners, as we’ve discussed, have already benefited from the QE based money printing but are now suffering with an expected increase in interest rates, a high energy inflation, and the risk of war economic scenario are all causing asset prices to correct.

The assetless and the debtless with disposable income, typically the young professional demographic are putting upward pressure on income levels due to their employment fluidity so remain a good segment to sell to.

Who does poorly with inflation?

During inflationary periods holders of cash lose out, as the purchasing power of their savings is eroded by rising prices. This can prompt cash holders to spend or invest that cash.

Inflation is particularly difficult for workers on fixed incomes - as prices rise, the value of their money falls and they find it harder to make ends meet. For this reason, in inflationary periods lower income households will spend a larger proportion of their wages on necessities due to price rises in food, housing and utilities like gas, leaving less money for discretionary spending.

Higher income households may also find themselves with less disposable income unless wages rise enough to keep pace with inflation.

For most borrowers inflation means that interest rates are likely to increase, in some cases stretching them to the point of default where they become unable to service their debt - this is a big problem, for another article.

Merchants analysis

Fast moving consumer goods (FMCG) and discretionary items are treated very differently during periods of inflation. Generally FMCG producers have upward pricing power to compensate for inflation without harming sales; discretionary items however do not and their margins are more likely to dip as upward pricing harms sales creating a lose lose environment.

Inflation and retailing

Throughout the pandemic, retailers have already contended with product shortages, supply chain disruptions, increased cost of business operations and swings in consumer demand, making the task of managing inventories extremely challenging in certain verticals.

Inflation attributed to these challenges can be laid out as:

1. Cost-Push Inflation:

- The cost of materials and commodities increased.

- Production was slower due to factories closing due to the pandemic.

- Slow and expensive procurement: the cost of transportation, shipping, storage increased.

- Shortage of labor due to a more expensive and smaller pool of workers in pandemic conditions.

2. Demand-Pull Inflation:

- Consumer demand surged in certain verticals during periods of lockdown.

- Consumers engaged in bulk saving during the pandemic and increased their spending as lockdowns eased.

- We predicted much of the demand-pull inflation in our March 2020 article, ‘This Time It’s Different’.

Impact on retailers

Still reeling and/or thriving from direct and indirect effects of COVID-19, certain retailers are facing significant margin squeezes from increased costs. The question now for retailers is: how much can they lift prices without losing sales? Passing costs on to consumers is always a difficult call even when your competitors are also facing margin squeezes. Some retailers can afford to lift prices more than others, but it depends on what you're selling and how price sensitive your customers are.

Consumer purchasing behavior and inflation

To understand how responsive demand for a good or service is to a change in real income, we can look to the concept of ‘income elasticity of demand’.

Think of ‘elasticity’ as ‘sensitivity’. You won’t be sensitive to price change if it doesn't take a big portion of your income.

During periods of inflation, consumers tolerate price rises on necessity products, such as staple foods (or non-essential products that are nevertheless treated like necessities such booze, chocolate bars or cigarettes); However, when it comes to larger purchases in verticals such as white goods, they may reduce or postpone spending on, for example, fridges or washing machines, if there is a noticeable price hike. This is especially true of lower and middle income consumers, for these consumers, given the ‘necessity’ nature of some of these devices sales are likely to continue, we can only expect lower price options to perform better than the middle.

By the same logic, higher income consumers who are less sensitive to price changes that occur during periods of inflation are less likely to withhold consumption. Goods in luxury verticals - which enjoy the additional advantage of strong consumer loyalty irrespective of price - are less likely to be affected by price changes, and may even benefit from the perceived ‘exclusivity’ of increased price (there are certain goods that become more desirable as they become more expensive, these are referred to as Giffen Goods). Top end white goods will continue to do well.

Outside of necessity items, optional spending categories are likely to take a hit.

With this in mind, retailers must make careful choices when raising prices depending on the vertical they operate in, and even treat segments within their vertical with some difference.

Performance of retailing in COVID-19

In this section, we explore the performance of different categories of retail during the pandemic. Global eCommerce sales jumped to US$26.7 trillion by May 2021, an enormous boost that reflected growing consumer demand for online shopping experiences.

Pharmaceutical

Pharmacies were among the few retailers who were able to continue operating through lockdowns for the entirety of the pandemic. With high demand for personal protective equipment (PPE), rapid antigen tests (RAT) and over-the-counter (OTC) medications, as well as periods of panic-buying, retail pharmacies saw massive sales boosts on certain products. However, a reduced number of walk-in shopper traffic also resulted in revenue shrinkage for some pharmacies, and due to market conditions independent pharmacies found it harder to compete with larger ‘banner brands’.

According to analysis from Deloitte, the key challenges pharmaceutical organizations and retail pharmacies faced during the pandemic were gaps in the global supply chain, which significantly impacted the sourcing, acquisition, and distribution of pharmaceutical products, medical supplies, and equipment. The rise of tele-communication and tele-medicine helped address issues around distributing products and redistributing inventory in response to deficits or surpluses, and the implementation of services such as at home delivery and click and collect represented a necessary shift to digital.

Fast Moving Consumer Goods (FMCG)

In what was dubbed the ‘homebody economy’, the pandemic saw consumers increase spending on grocery, household, home cleaning, hygiene and fresh produce products. Supermarkets and grocery stores remained open throughout lockdowns, however with consumers reducing their number of weekly shopping trips and spending more time indoors, online shopping and shopping delivery services surged in popularity. For this reason, retailers with strong digital capabilities experienced growth (often having delivery slots booked for months in advance), while the retailers with weaker eCommerce offerings lost out on consumer interest. Panic buying and hoarding saw demand for FMCG, especially longlife or storable food goods and home luxury goods surge at different points in the pandemic, and this along with disruptions to the supply chain resulted in intermediate shortages of certain products.

Overall, the FMCG Industry is one of the key industries that significantly grew during the COVID-19 crisis. Compared to March 2019, in March 2020 USA interest in these goods increased by 53%. Retailers in France, Germany and the UK also saw record sales of basic products like pasta and soap, in countries such as Australia, shifts in spending habits saw customers buying more locally produced goods than they did pre-pandemic.

Booze

With closures and restrictions of hospitality venues and events, increased purchases of alcohol for use at home surged in North America, Europe and countries such as Australia, most notably in the first three-quarters of 2020 with the first wave of COVID-19. As was true of pharmaceutical goods and other FMCGs, retailers who were able to improve their eCommerce capabilities saw significant growth in sales.

Liquor store sales in The United States, from March to September 2020, were US$41.9 billion, representing an increase of 20% and 18% compared to the same period in 2019 and the previous seven-month period respectively. In Australia, between January 2019 to the end of 2021, alcohol sales online and in bottle shops jumped by 29%, which equates to a AUD$3.6 billion increase.

High alcohol retail turnover can likely be attributed to the stressful experience of pandemic conditions, as well as the spending of disposable income that might otherwise have been used on nights out or dining out by consumers.

Books

The publishing industry has dealt with many ‘existential’ threats in the past 20 years, mostly related to the rise of ‘digital disrupters’ and technology such as social media that competes for the attention of readers. Retailers certainly experienced anxiety around the closure of physical stores in periods of lockdown, nevertheless, book sales during the pandemic fared extremely well, with the popularity of ebooks, e-reader technology and the ability to buy books online further strengthening sales.

Over 200 million print books were sold in the UK during 2020,the highest number since 2012. The overall value of UK publisher sales in 2020 was £6.4 billion, 2% higher than 2019 figures.

It’s also important to note that research from the USA Bureau of Labor shows that book purchasing and book reading skewed heavily toward higher income consumers. The top 10% of earners spent nearly 8.5x more on reading than the bottom 10%, meaning that the financial impact of COVID-19 on lower income earners did not affect the bottom line for publishing and book retailing’s bottom line.

Electronics

In the first three quarters of 2020, the COVID-19 pandemic caused a 30% drop in electronic and electrical equipment sales in low and middle income countries, but only a 5% decline in high-income countries. Overall, sales of telecommunications equipment only decreased globally by 1.4%, with demand for laptops, cell phones, and gaming equipment rising in high income countries but falling in low and middle income countries.

Electronics retailing was affected by supply chain disruptions, with many factories either closed completely or operated with reduced capacities during the pandemic. As a result, there were delays in the production and distribution of products such as the Nintendo Switch (although there was high consumer demand for this product, Nintendo experienced challenges in bringing it to market due to supply chain complications).

White Goods

Worldwide, sales of heavy electric appliances like refrigerators, washing machines, and ovens dramatically fell by 6–8 % the first few months of 2020. Demand then fluctuated throughout the pandemic for different kinds of goods, with kitchen appliances and home improvement products such as air purifiers experiencing the biggest surge in sales. However, big ticket items such as fridges and washing machines which are expensive and need installation (something that was not possible under strict lockdown regulations) saw a contraction in sales during periods of lockdown. These products were also affected by supply chain shocks as the halt on production of electronic parts took effect, however by 2021, ecommerce platforms such as Amazon and Flipcart were beginning to see a significant uptick in sales on larger white goods once again.

Automotive

The automotive industry was severely impacted by COVID-19. During 2020, car sales plunged in China, and by April 2020 the same was true of the United States and Europe. Supply chain disruptions in China were a major problem for production, and this combined with large scale manufacturing shutdowns in Europe and closure of assembly plants in America contributed to a massive global downturn in distribution and sales. The effect of various lockdowns and the movement to working from home likely contributed to a downturn in consumer demand for cars during the pandemic.

The one notable exception to this trend was in luxury cars. Rolls-Royce CEO Torsten Müller-Otvös some what infamously credited COVID-19 for the sales boost during an interview with The Financial Times, claiming that the pandemic had made people realize that “life can be short, and you’d better live now than postpone it to a later date…That has helped Roll-Royce.”

Luxury

In a similar vein, despite supply chain challenges, luxury goods were increasingly in demand over the course of the pandemic. Jeweler Cartier reported a 30% increase in sales during the last three months of 2021 compared to the last quarter of 2020, while Italian fashion house Prada earned 8% more in 2021 than pre-pandemic sales in 2019. Louis Vuitton, Dior, and BMW all reported mid-January 2022 numbers showing that sales have exceeded those in 2020, and actually outpaced pre-pandemic sales.

Fashion

In the early months of 2020, most fashion retailers experienced short-term impacts of simultaneous ‘demand and supply shocks’ brought about by government lockdowns and limited or completely decimated foot traffic to bricks and mortar stores, with many physical stores shutting shop.

That didn’t stop people discovering fashion online, and sales have in aggregate continued to grow.

Beauty

The so-called ‘lipstick index’ - a term coined by the former Estée Lauder chairman Leonard Lauder in the early 2000s, describes usual resiliency of cosmetics in economic times of hardship. However, COVID-19 brought with it a new set of challenges for the cosmetics industry, chief among these being face covering required by law. In light of lockdowns and social distancing, many consumers were wearing (and therefore buying) less makeup.

The partial or complete closure of bricks and mortar department and high street stores saw the sale of make-up plummet 40% in 2020 in the UK (which represented approximately £500m, according to the market researcher NPD). In comparison, sales of skincare, body and hair products increased by 234% in the UK in 2020 alone, and this reflected a change in spending priorities for consumers.

Finally, as with many other verticals, COVID-19 majorly accelerated digital transformation in beauty retail, with companies such as L’Oréal reporting that eCommerce now represents close to 20% of sales.

Prospects for retail in inflation

So that’s where we were. Recent events, however, bring about new challenges. Next we explore how we expect different categories to fare in an era of high inflation, spark a debate, and propose technological and data solutions that can prepare retailers for potential instability.

Pharmaceutical

As pharmaceuticals are necessity goods, consumers will buy them regardless of higher prices. Post pandemic, the demand for pharmaceutical drugs has been higher, so we anticipate that the total demand and total spending of consumers in this vertical will remain unchanged.

Fast Moving Consumer Goods (FMCG)

Fast-moving consumer goods will continue to be sold despite rising inflation and have great price elasticity. Commodities prices will continue to rise as some resources become more scarce (cooking oil, tea, cocoa etc) both in production and supply chains. With the outbreak of the pandemic, consumers were quick to hoard FMCG, this anticipation of supply shortages ironically was the cause of some supply shortages. We are still experiencing shocks to the supply chain and shortages and we anticipate FMCG will continue to generate higher revenue as prices increase.

Booze

Alcohol is often described as a ‘recession proof’ product, and this holds true amid rising prices during inflationary periods. With demand being inelastic, suppliers and retailers benefit from passing on the higher percentage of costs to buyers.

Books

Books are unlikely to be impacted, since how much a book 'should' cost isn't obvious. In an ideally competitive industry, it would be costs plus normal profit margins. The rapid growth of e-book sales complicates the analysis further. However, costs have certainly been coming down on the production front thanks to technology, although they may well have gone up on the marketing front.

Electronics

In 2022 electronics retailers will contend with rising material and labor costs as

manufacturers hike prices to minimize the damage done to their bottom lines by various disruptions to the global supply chain, commodity prices etc. Retailers will have to raise prices to sufficiently cover these costs, or risk having margins squeezed.

Increasingly, electronics are marketed and treated as necessities rather than luxuries (as they were in the 20th century). With consumers becoming more dependent on these products we begin to see price inelastic demand, and even if items such as laptops and phones begin to take up a bigger proportion of disposable income, higher prices from the retailers will not deter consumers from upgrading and purchasing new electronics, especially if there is a clear need to buy (for example, if your laptop breaks down you’ll replace it as quickly as you can because your work and personal life depend on it!).

There are however luxury, non-necessity items. So where phones and laptops will likely be fine, sound technology for example may struggle somewhat.

White Goods

When white goods purchases make up a higher portion of income, consumers aim to make more savvy choices and hold back spending until a good deal or a discount appears. Whilst there is currently a general trend of increased prices (resulting in higher revenue per transaction for retailers) consumers don’t tend to hoard white goods and electronics from anxiety around supply shortages. Overall, delay of consumption reduces the growth of revenue and profits for white goods retailers.

That said, many items are necessities so there is some support here.

Price checking is already rife in this category, and we imagine it will only increase. Short of a race to the bottom, intelligent incentive programs will be pivotal to win in this retail category.

Automotive

Both new and used cars are becoming more expensive. The rising price of new cars has been partly attributed to a shortage of semiconductors used in the manufacturing process, as well as a backlog from the closure of factories during the pandemic. The cost of used cars is currently higher than at any other time this century. Cox Automotive reports that as of December 2021, the average retail price for a used vehicle in the United States is now a new record of more than US$28,000. Given that many people are still working from home, or reducing travel, it’s likely that used car prices will continue to rise as consumers opt for used cars instead of new ones.

It’s even more pronounced in countries that don’t make their own cars any more, like Australia.

Rising oil prices can have a big impact on the buying behavior of consumers when it comes to cars. The historical oil crisis of the ‘70s (which resulted in massive inflation and unprecedented gas prices) made small fuel efficient cars popular, and chief among these were the Volkswagen Beetle and the AMC Pacer. The market competition between these two cars gave consumers more options and helped to keep prices lower.

Unfortunately, in 2022 the auto industry is still battling supply chain complications, meaning dealerships are still experiencing shortages and consumers have less choice. However, with oil prices rising once again, there has been an uptick in demand for electric vehicles such as the Tesla Model 3, with EV car sales increasing by 76.3% in 2021 in the UK alone. Australia recorded 20,665 EV sales in 2021, a significant increase from the 6,900 sold in 2020, which means electric cars now make up 1.95% of the new car market. In the United States, EV sales were 735,000 in 2021, up from 375,000 in 2020 reaching 4.4 % share (up from 2.3 % in 2020).

Luxury

Brand loyalty plays a huge role in customer retention, as long as brands deliver products that meet expectations of quality, exclusivity and remain true to the legacy and heritage of a luxury brand, customers will continue to buy irrespective of price rises. The rich stay rich (or at least aspirational) afterall!

The pricing power of luxury brands is clear in the rises we’ve already seen during the pandemic. For example, LVMH increased prices on the Louis Vuitton brand roughly 5% across the board in 2020 without negatively impacting sales volume.

Although there will be a fall in demand from low to middle income consumers, higher income consumers are unlikely to change their spending behavior in the luxury vertical. Due to the strong emotional attachment luxury brands enjoy, we anticipate a general growth in revenue in this vertical.

Beauty

The rising cost of raw materials used in beauty products (chief among these being palm oil which has soared 82% in two years due to Indonesian labor shortages), as well as transport, labor and energy costs have resulted in a “once-in-two-decade” backdrop for price hikes according to Unilever’s CEO Alan Jope.

Nevertheless, as lockdowns and social distancing restrictions continue to lift, consumers will be spending more time outside the house and we anticipate that demand for beauty products will rise irrespective of price hikes.

This could already be seen in 2021 as restrictions eased in certain countries, with the UK seeing a 2.6% increase in beauty product sales by the end of the year. Skincare brands saw the highest growth, which indicates the demand for ‘self care’ items established during the pandemic is still surging.

To balance the costs of rising prices for consumers, some retailers will opt for periodic flash discounts, savings on shipping, and opportunities to earn loyalty points and commissions when they shop more often and/or refer new customers. Retailers will attempt to limit price rises for drugstore cosmetics as they aim to shift large quantities of inventory quickly.

Luxury items might perform well despite price increases due to the strong consumer loyalty to these brands, however current data from Particular Audience clients suggests that items considered luxury in beauty and pharma are actually suffering vs lower cost substitutes, suggesting a converse luxury effect in this vertical.

Furniture & Homewares

Heavy goods, often made overseas, have been most impacted by supply chain bottlenecks, labor shortages and now the ramping cost of raw materials. The average wait time for a new sofa can be months not weeks.

Consumer demand will vary depending on their circumstance, the luxury segment is again likely protected. The more accessible tiers are already adjusting prices upward, notably IKEA raised prices 9% on supply chain woes alone, that was prior to the outbreak of war and energy price shocks.

Efficient inventory allocation is going to be key in maximizing margins during this time, at Particular Audience we have a ‘Data Science as a Service’ team that specializes in exactly this. Nike is an example of a brand/retailer that has already brought this in house with their acquisition of predictive analytics and demand sensing business Celect in 2019, great timing for them.

Fashion

The business model of the apparel industry relies heavily on moving volume. Fashion retailers aim to sell as much as possible as swiftly as possible, shifting their inventory quickly to avoid mounting storage costs.

Although the price of clothing and footwear in the United States has risen recently, with prices up 5% over the course of 2021, US fashion prices are ultimately down 7.9% from 30 years ago thanks largely to the rise of fast fashion. Items like jeans and tshirts actually cost less on average than they did in the eighties, and fashion has seen a steady deflation since that time with companies cutting costs and avoiding raising prices by moving manufacturing overseas.

Bargain prices have resulted in Americans buying five times more clothing than they did in 1980, and the enormous demand for clothing has only increased with digital transformation and the rise of eCommerce, as well as influencer marketing and impulse discovery, which has helped many retailers weather the pandemic storm and closure of bricks and mortar stores.

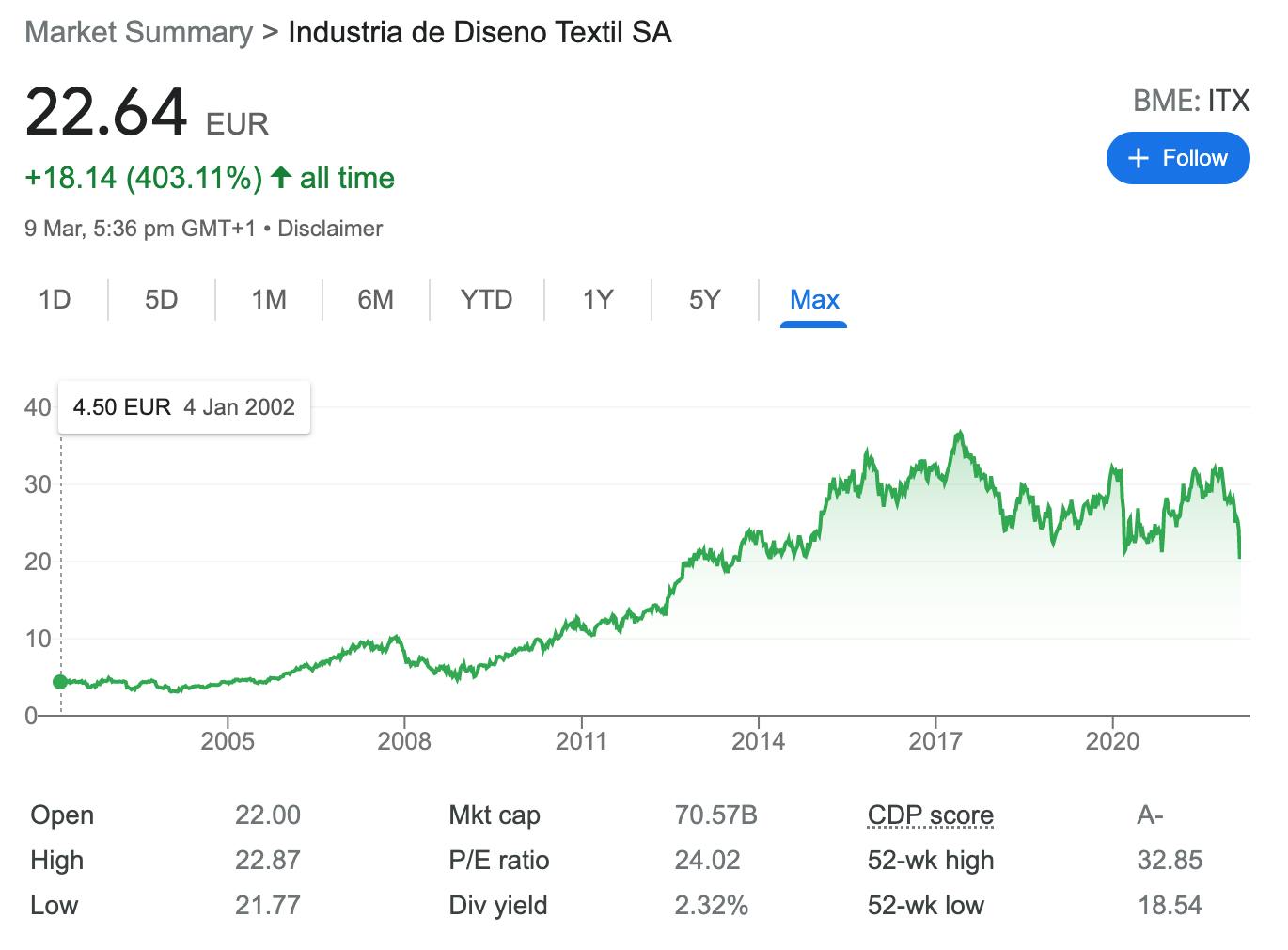

This decrease in price to the consumer has meant that retailers need to hit higher volume to make the same money. Those that have succeeded are giant businesses today, just look at EUR 70bn Zara owner Inditex for proof:

With ongoing supply chain issues such as factory shutdowns, surging raw material prices (such as that of cotton) and shipping goods by air freight (a process more expensive than ocean shipping) cost pressure is increasing. The question is whether costs can be passed onto consumers used to low consideration impulse purchases. We think not, since this is a market predicated on low costs.

We anticipate that retailers will attempt to limit price hikes to retain sales but disappearing margins mean they need to take action fast.

Shein is the leader in the pack with their massive offering, made on demand low waste(!?) business model. For other retailers, this level of demand led production is difficult to replicate. In the following sections we outline some more achievable strategies for fashion retailers to protect themselves, which include selecting performance and/or usage priced tech vendors, margin accretive CRO strategies that look beyond topline uplift, and new ways to monetize traffic outside of physical item sales (such as Retail Media to capitalize on clicks, and digital merchandise strategies).

The inflationary environment we’re moving into may also present a market opportunity for retailers of sustainable, high quality and ethically manufactured apparel as the movement for ‘slow’ fashion gains popularity among certain consumers. If consumers have less disposable income, they could make more considered choices, meaning quality and ethical considerations may inform their buying behavior, prompting them to invest in fewer, better quality items.

Recap

For retailers in general, the obvious risk is that rising prices will eat into profits or even lead to losses. If you own a corner store, for example, and the cost of a loaf of bread goes up by 10%, that increase is going to be passed on to customers in one way or another. You may lose sales if people perceive they can get a better deal elsewhere, or if they simply can't afford your product any more. But as long as you can pass on the cost increases to customers, then profits should be protected — right? Not necessarily. Most retailers are working with relatively thin margins (after marketing) — often less than 10%. A 10% increase in costs might not be so easy to pass on to customers.

The more competitive a retailer's vertical, and the less necessary the product being sold, the worse a retailer will fare during inflationary periods. This would be even more pronounced in a stagflationary scenario, which would prompt a follow up article to this one.

If a retailer’s inventory is a total necessity, is not a high consideration purchase, and that retailer is part of a duopoly or monopoly then they will do relatively well as they are most able to raise their own prices. Retailers are going to see their cost bases go up - even Visa and Mastercard are increasing their take.

Consumers get stung by inflation and they become worse off, which poses a demand risk to retail.

The good news is that retail is relatively inefficient as a whole, thus has a lot to gain from honing in on that inefficiency, mining untapped value in data and optimizing operations to counter the forces of inflation and potential drops in consumer demand.

Solutions & how retailers can prepare

Inflation is driving up the landed cost of products retailers are purchasing. Retailers aren't pushing along 100% of these costs to the end consumer, therefore they are getting squeezed on a shorter margin which has a detrimental impact on overall profit.

Smarter Conversion Rate Optimization

It’s no secret that onsite personalization, relevancy and time-to-checkout can all increase conversion rates. In an era of margin conservation, it is important to grow sales profitably.

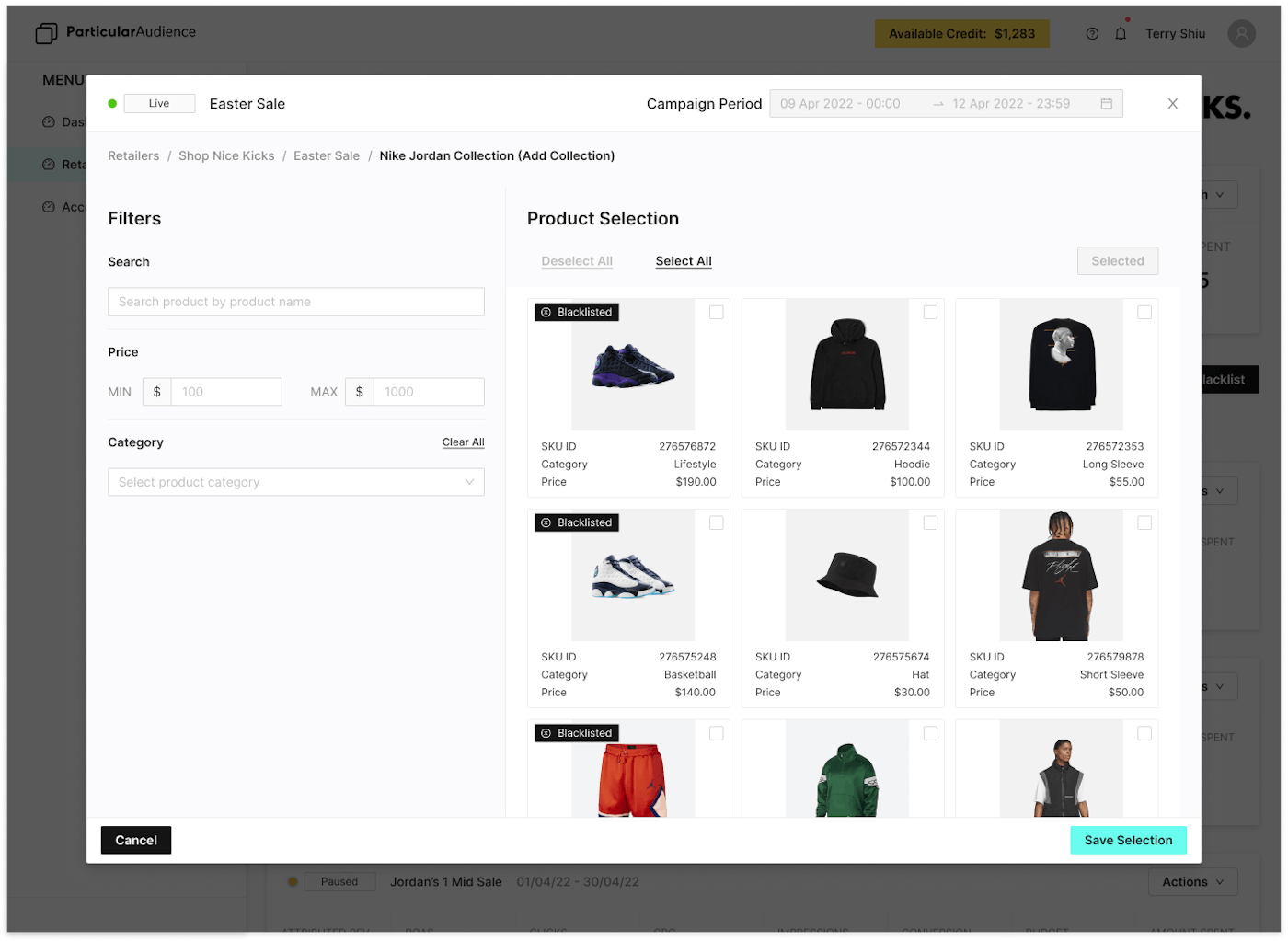

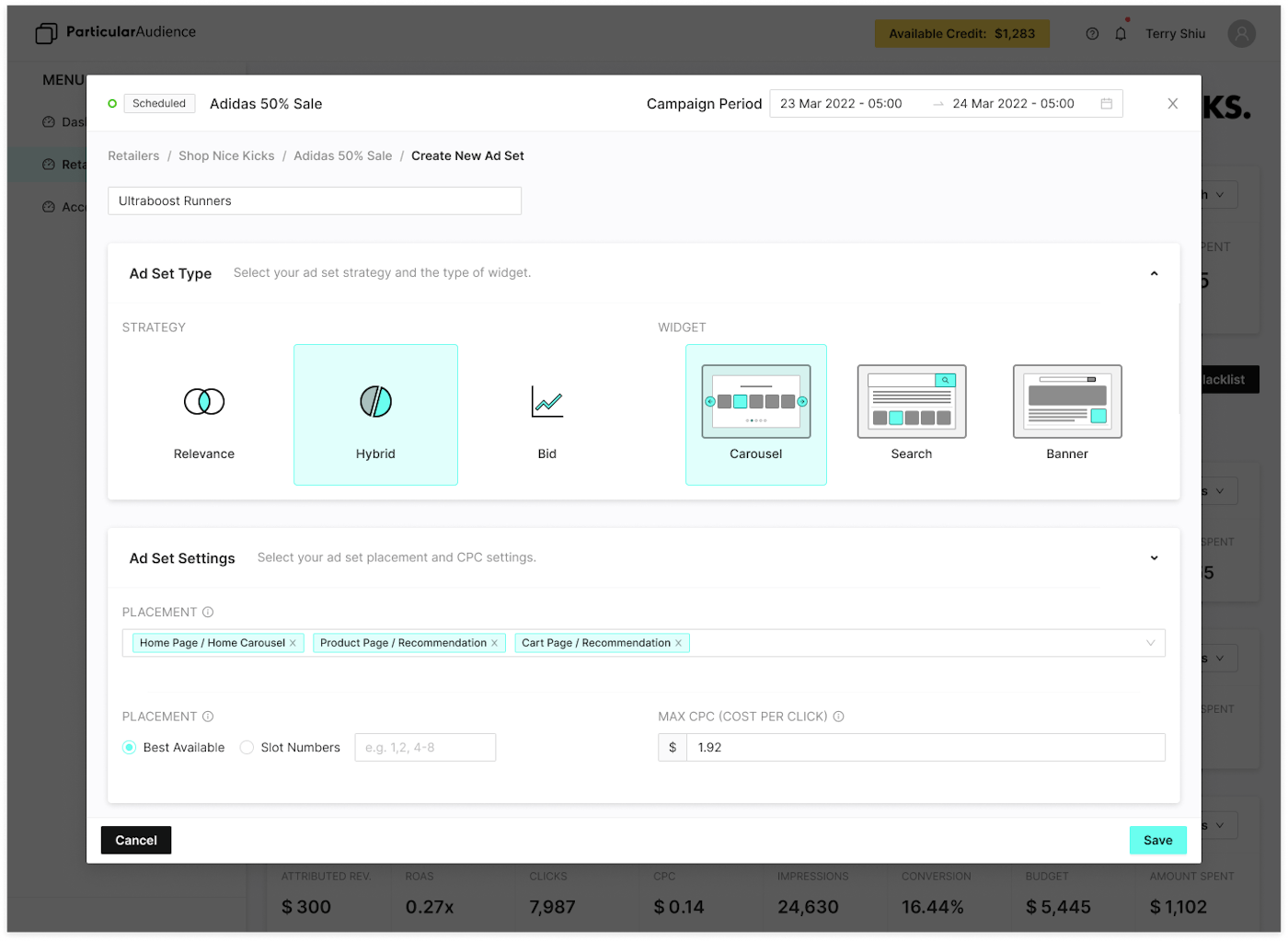

Particular Audience enables scalable merchandising within onsite search and product recommendations through boost and bury logic that helps prioritize items displayed by regional local inventory, margin, stock-on-hand and other KPI drivers.

This dexterity for e-tailers is imperative to balancing relevant customer experiences in a way that helps businesses achieve KPIs outside of pure sales volume.

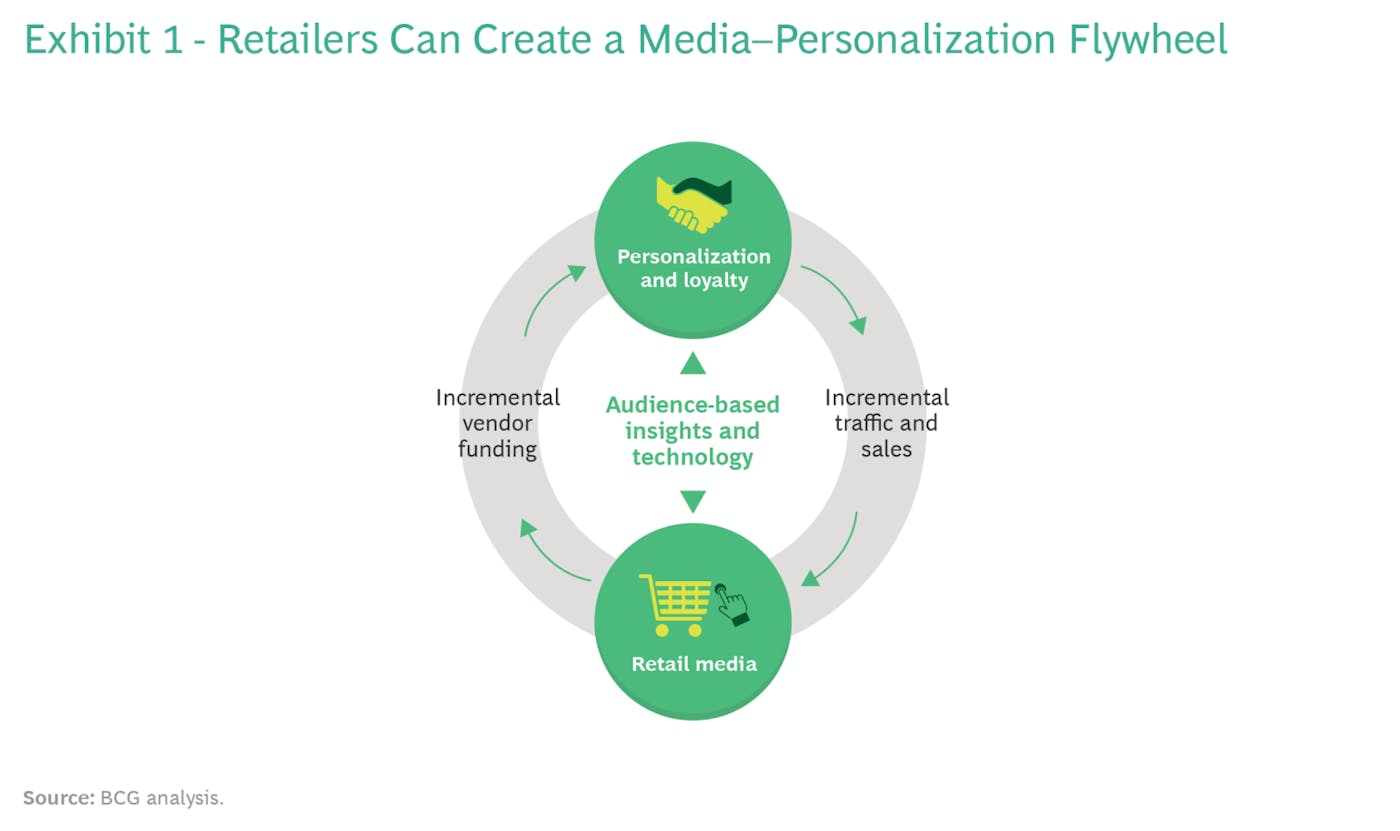

Alternative monetization strategies: Retail Media

Your top search result can deliver ~30% of sales, and brands are willing to pay to appear there. Retailers are leaving money on the table by not having an integrated Retail Media strategy up and running. BCG calls it the $100 billion media opportunity for retailers.

Retail Media revenue is a high margin/high profit revenue stream that will go directly to the bottom line which in addition, drives incremental sales both directly and indirectly, by funding things such as onsite personalization.

Amazon made US$39bn from their Retail Media business in 2021, Particular Audience makes this same revenue stream available to every other retailer on the web, with an easy to use application to automate vendor marketing strategies in a scalable and profitable way.

This high-margin advertising business is part of what Walmart calls its “growth algorithm” – a plan to invest heavily in brick-and-mortar overhauls and fulfillment while maintaining or even growing its overall margin.

The two things have to go together. Walmart’s margins are under pressure from inflation and the current labor and supply chain crunch as well as long term investments in home delivery, new store setups to accommodate online pick up orders and its growing grocery business. Groceries are low margin sales however valuable as the category brings loyal, regular shoppers.

To balance those investments, Walmart is adding high margin businesses, such as the third party seller marketplace and, notably, advertising.

Other retailers can, too, get in touch with Particular Audience to get started at no cost.

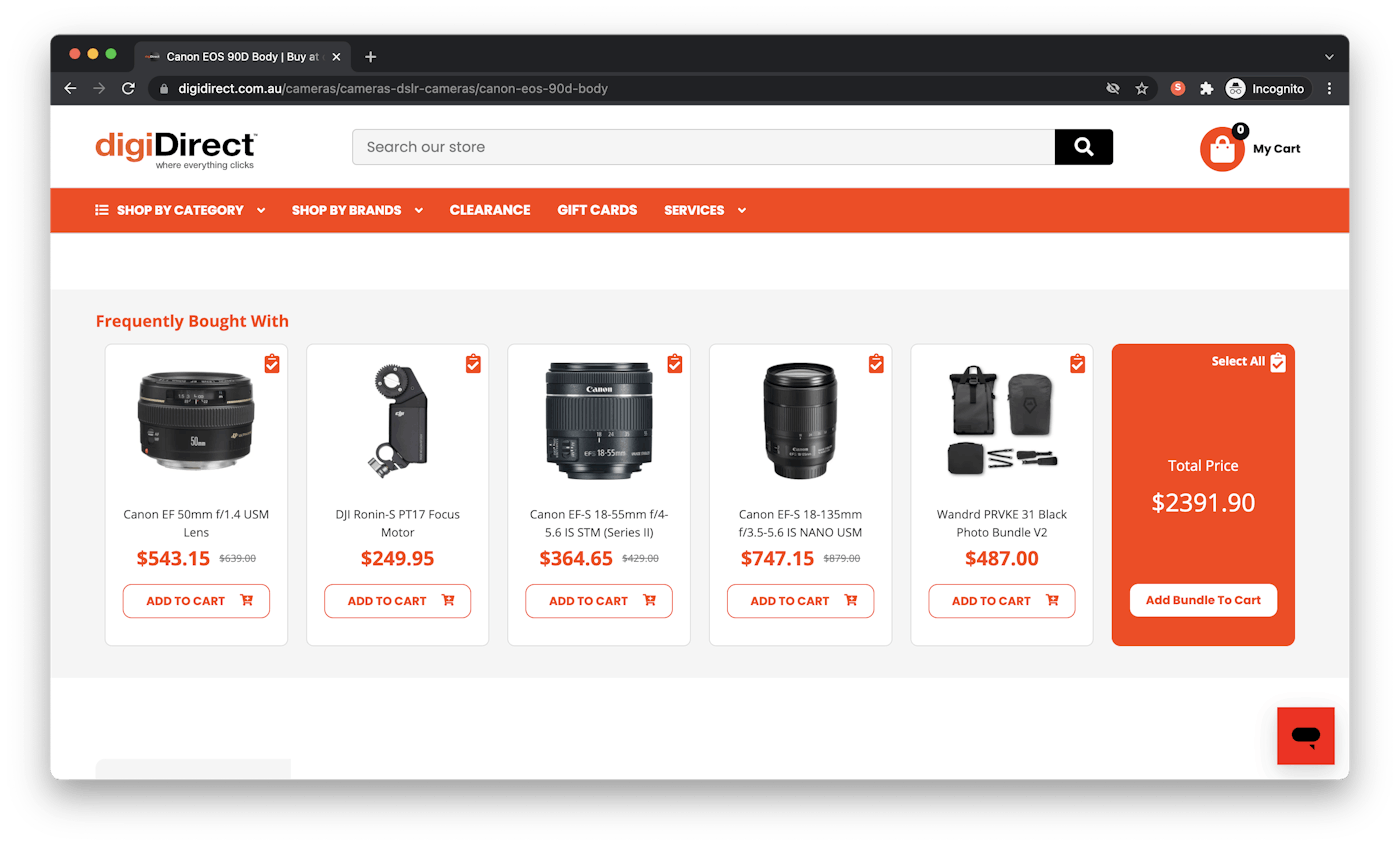

Increasing units per transaction

Automating product bundles can be a massive win for retailers looking to add more items per shipment, creating micro-economies of scale in more orders. This is Amazon’s number one basket size driver and is something Particular Audience enables other retailers to automate.

Automated bundles are the lowest hanging fruit on any eCommerce website. Not only do bundles grow AOV, but margin efficiency from merchandiser time savings, increased units per transaction and being able to send more items per delivery is an incredible value proposition.

Retailers using PA’s AI Powered 1-Click Add-to-Cart Bundles see a +30 to 60% increase in units per transaction, improving shipment efficiency and increasing sales in a way that lifts margins.

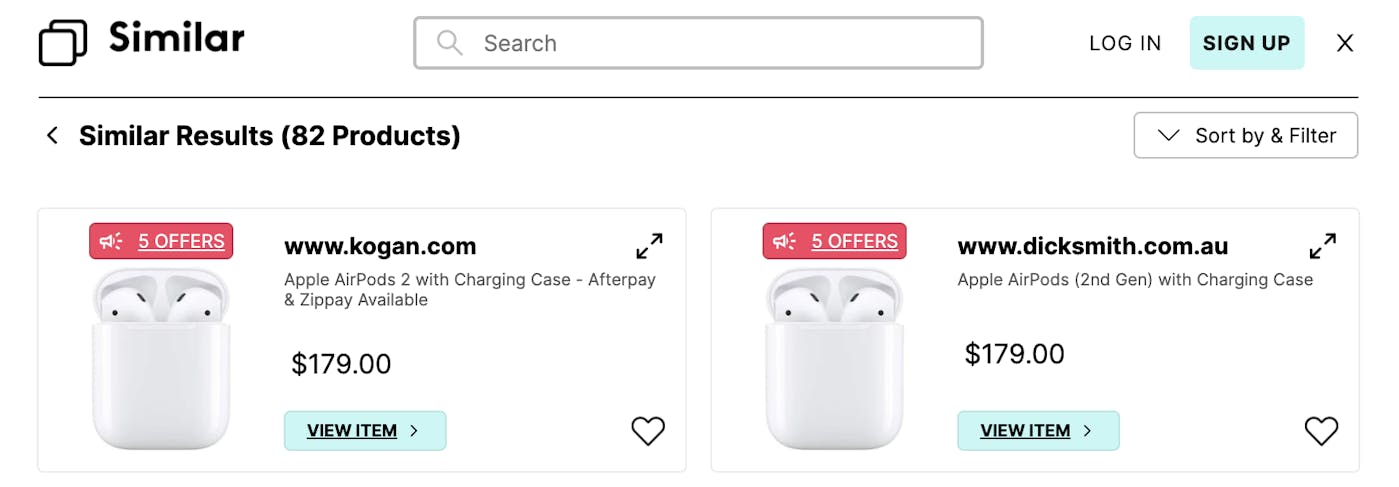

Smart pricing strategies that don’t create a race to the bottom

The key thing here is that retailers do not need to drop prices across the board for Amazon to scrape and undercut even further. They can delight their customers with real time best value and preserve margin while converting double the number of customers, capturing price conscious shoppers that otherwise abandon websites to price compare elsewhere.

Similarinc.com enables real time price comparison for users of its chrome extension. Retailers can leverage this technology on their own sites, in real time, to price beat competitors thereby retaining and converting traffic that they’ve already paid for.

The impacts of this can be as extreme as a 102% increase in conversions on participating categories at a cost of as little as 2% to margin, which is one of the most awesome economic ratios available in conversion rate optimization and pricing strategies available to retailers today.

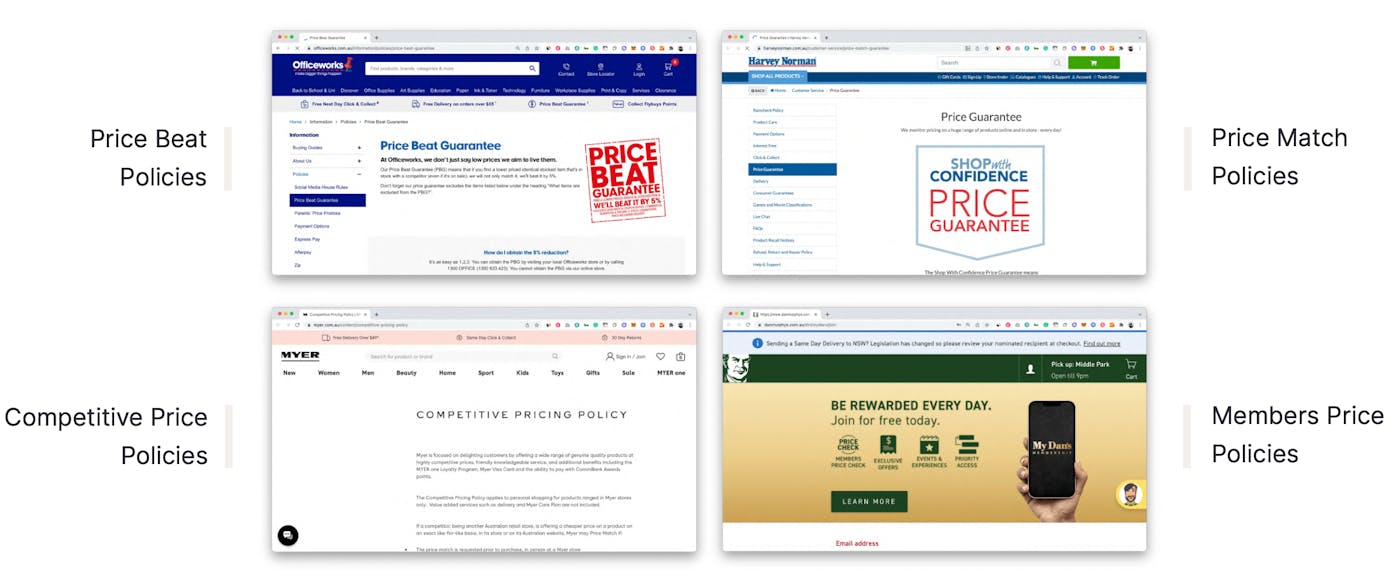

This technology automates price beat, price match, competitive pricing and members pricing policies online which retailers have never been able to do previously outside of their physical stores. No more wordy policies that require in-store visits, phoning in to validate, or ambiguous adherence to policies that put reputational risk on the retailers that offer them.

Applications even include price affirmations that a shopper already has the best price if they checkout there and then: all with third party trusted validation.

Select performance and/or usage priced tech vendors

Companies like Twilio, Yotpo and others have spearheaded usage based pricing via API models superseding many older fixed fee alternatives.

Cost per sale variable pricing also exists, guaranteeing marginal cost per sale.

This guarantees return on investment at a preset margin, while driving incremental sales with no surprise costs.

PA also offers various API first applications that are purely usage based and cost only scales as you do.

Invariably there are services we offer that do not lend themselves to sales based pricing models, including our ‘Data Science as a Service’ and managed service search implementations - however, these are modularised so retailers can pick and choose what they need to derive value.

Retailers should look for transparency, modular pricing optionality and cost models that align with value generation when selecting technology vendors. It’s a no brainer, especially where costs need to be scrutinized and profitability needs to be not only measured but grown.

Optimize your inventory allocation

Preserve margin and free up cash, through services such as Particular Audience’s ‘Data Science as a Service’ reporting, control merchandise through boost and bury within personalization to reduce the amount of stock that ends up on markdown (more relevant eyeballs = more sales at full prices), and increase mixed baskets to complement low margin goods with high margin cross-sells.

Dependency and/or Choice Modeling provides intelligence on which items depend on others to sell, and which items cannibalize. Improving stock depth and allocation decisions.

The data retailers need to do this effectively exists entirely within their existing eCommerce websites and is often completely underutilized. Some examples of inventory allocation optimization in practice include:

Customer choice modeling:

Look at the sale rate of items against one another, when both items are considered in a journey. Equating competitive cannibalisation.

Data used: Items often viewed together, item sales.

Application: To inform buying teams to optimize assortment.

Understanding codependency:

Look at items that don’t sell when another item is out of stock or unavailable.

Data used: Items often viewed together, item sales, inventory.

Application: To inform buying and allocation teams.

Identifying co-sell opportunity:

Look at bought together pairs and identify where items are missing in certain stores. If the connection is strong enough, we recommend stocking items in absent stores.

Data used: Items often bought together, store specific inventory.

Application: To inform stock reallocation.

Identifying out of stock missed opportunities:

Look at geo-segmented demand data from the webstore, and identify where items are missing in respective proximity stores. We recommend stocking items if demand is significant.

Data used: Items often bought together, store specific inventory.

Application: To inform stock reallocation.

Clients would provide inventory data by location. We would use geo-data where necessary.

Get in touch with Particular Audience now to learn more about this service.

Closing notes

We are in risky territory, and retail businesses need to prepare for all outcomes immediately.

To stem inflation, amongst other things, governments can increase interest rates and cut public spending - however, if economic growth is threatened governments will be disincentivised to control inflation in that way. Treading a fine line for economic stability is complex.

The war in Ukraine will trigger a massive negative supply shock to the global economy, reducing growth and further increasing inflation at a time when inflation expectations are already ballooning. The risk here is that we could evolve from inflation into stagflation (where inflation continues as economic growth slows or disappears). This is a terrible scenario where consumer appetites would reduce significantly, while businesses face continued cost pressures.

Retailers must work objectively to reduce the landed (delivered) cost of an item, to minimize markdowns (discounts, triggered by an inability to sell enough quickly) with data enabled merchandising and implement ways to automate this on their websites and backend IT systems.

Retailers should work smarter to improve cash-on-hand so they have agile flexibility to re-invest in the highest performing stock and/or marketing channels. Personalization and relevancy across all customer facing product lists (search, merch and recommendations) will help retailers liquidate the long tail of inventory without increasing markdowns prematurely.

Retailers must renew efforts to increase turnover (the ratio between sales and total assets) by replacing tired systems and making the most of the huge data they have available to use that is often underexploited today. Retailers should consider obtaining cheap leverage while it is available on a fixed rate basis, capitalization will be key while margins are under stress and will fund business transformation and data initiatives that will continue to pay dividends as the economy fractures.

Data technology, automation and ROI linked pricing models are quickly becoming the number one focus for retailers globally. Particular Audience and Similarinc.com are here to help.